UNITED STATES

SECURITIES AND EXCHANGE COMMISSIONWASHINGTON,Washington, D.C. 20549

________________

SCHEDULE 14A

________________

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant |

| |

| Filed by a Party other than the Registrant | ☐ |

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material |

Bull Horn Holdings Corp.

BULL HORN HOLDINGS CORP.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table below per Exchange Act Rules | |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

| 0-11. | ||||

Bull Horn Holdings Corp.PRELIMINARY PROXY STATEMENT

SUBJECT TO COMPLETION DATED SEPTEMBER 30, 2022

BULL HORN HOLDINGS CORP.

801 S. Pointe Drive, SuitePOINTE DRIVE, SUITE TH-1Miami Beach, FLMIAMI BEACH, FLORIDA 33139

Dear Shareholders:

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON ___________, 2022

TO THE SHAREHOLDERS OF BULL HORN HOLDINGS CORP.:

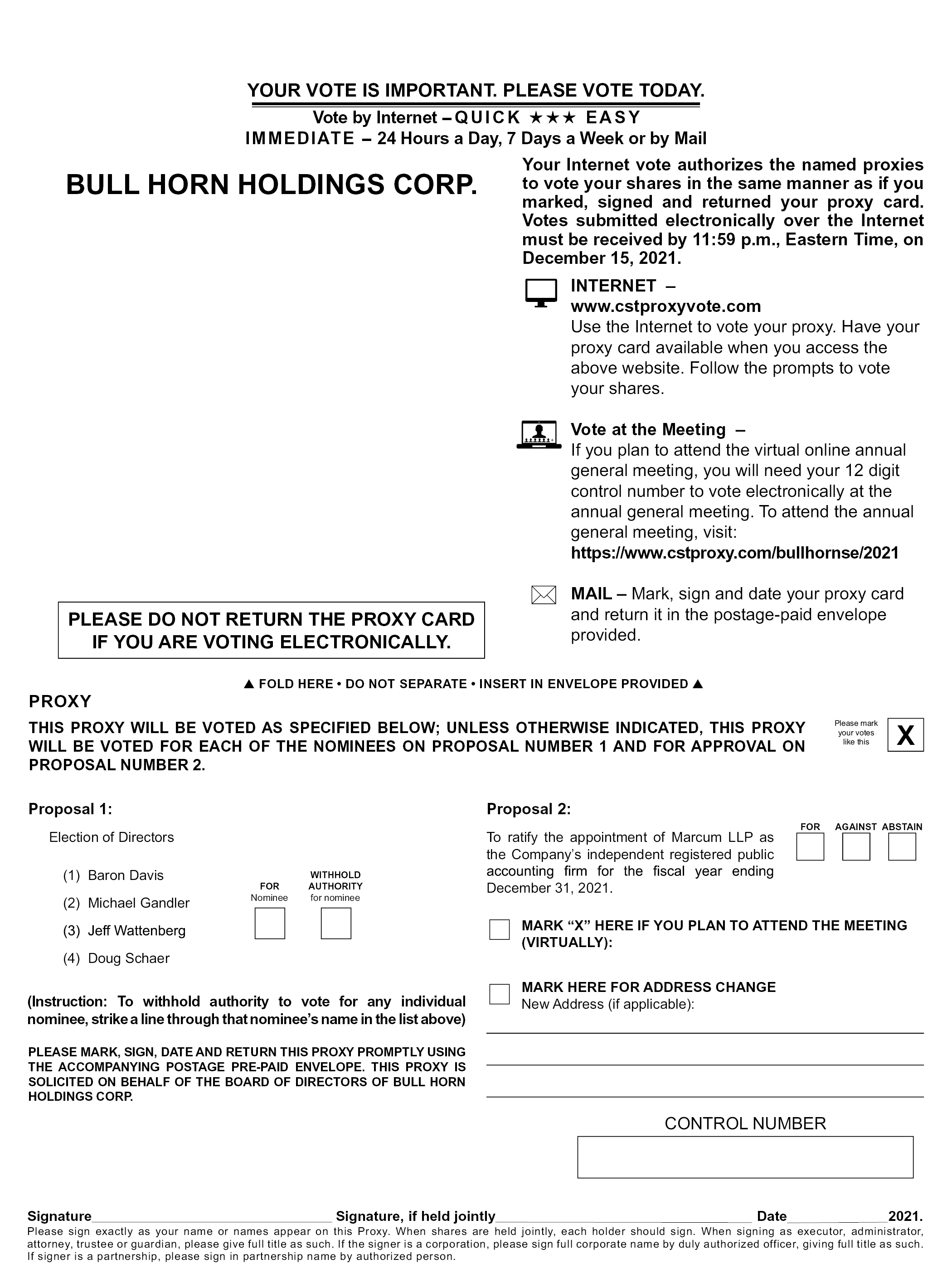

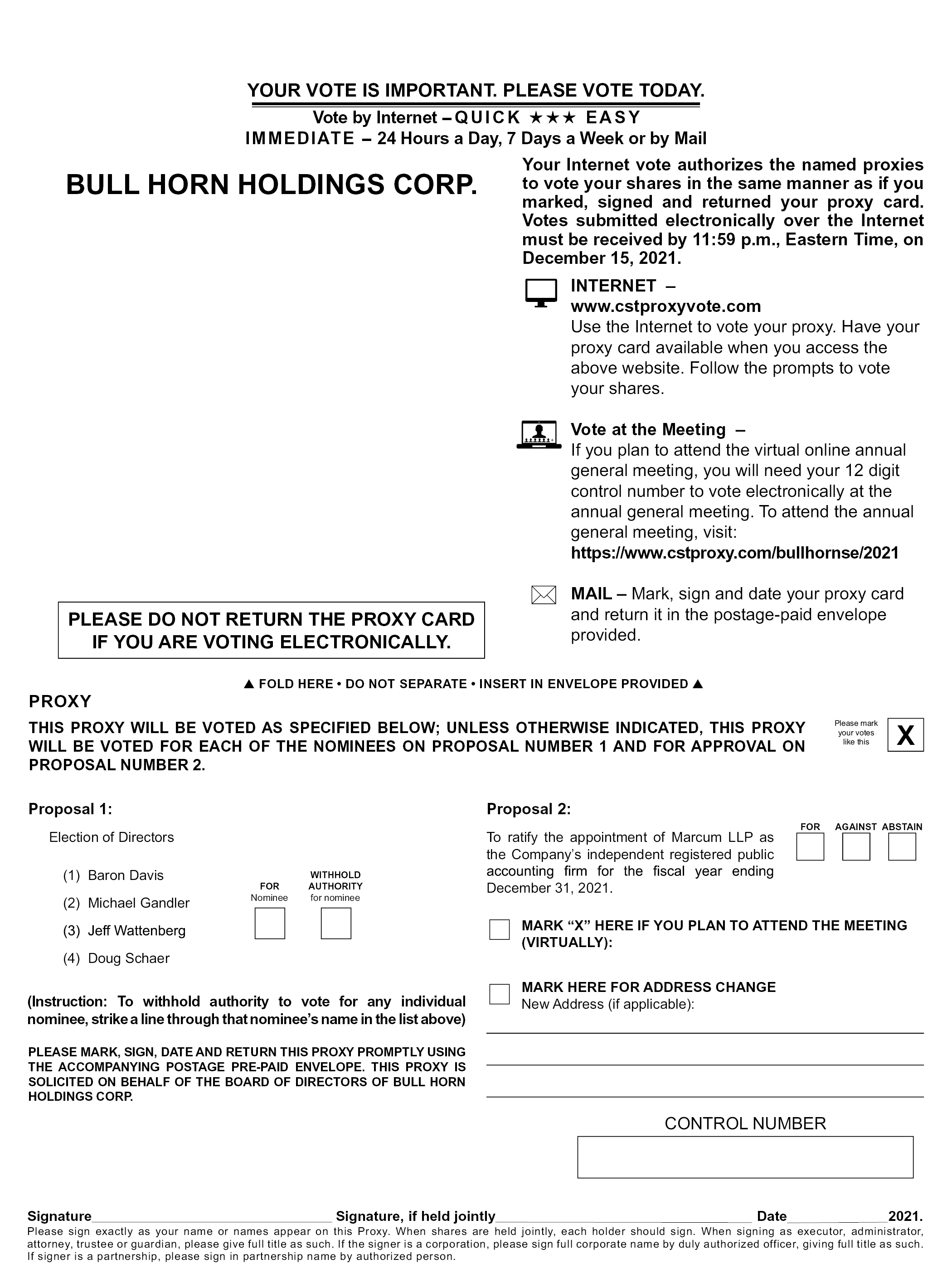

You are cordially invited to attend the 2021 Annual General Meetingspecial meeting (the “special meeting”) of Shareholders (the “Annual Meeting”)shareholders of Bull Horn Holdings Corp. (the “Company(“Bull Horn,” “Company,” “we,” “us” or “our”) to be held at 10:00 a.m. Eastern Time on December 16, 2021,___________, 2022. The formal meeting notice and proxy statement for the special meeting are attached.

The special meeting will be a completely virtual meeting of shareholders, which will be held at 2:00 p.m. Eastern Time, as a virtual meeting. Enclosed with this letter are your Notice of Annual Meeting of Shareholders, Proxy Statement and Proxy voting card. The Proxy Statement included with this notice discusses each of our proposals to be considered at the Annual Meeting. Please review our annual report for the fiscal year ended December 31, 2020, whichconducted via live webcast. You will be on our website at able to attend the special meeting online, vote and submit your questions during the special meeting by visiting https://www.cstproxy.com/bullhornse/2021.___________. We are pleased to utilize the virtual shareholder meeting technology to (i) provide ready access and cost savings for our shareholders and the Company,company, and (ii) to promote social distancing pursuant to guidance provided by the Center for Disease Control and the U.S. Securities and Exchange Commission due to the novel coronavirus.Coronavirus. The virtual meeting format allows attendance from any location in the world.

At this year’s

Even if you are planning on attending the special meeting online, please promptly submit your proxy vote by Internet, telephone, or, if you will be asked to: (1) elect four (4) “Class I” directors, namely, Michael Gandler, Jeff Wattenberg, Douglas Schaer and Baron Davis, eachreceived a printed form of whom will be elected for a term of two years; (2) ratify the appointment of Marcum LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021; and (3) transact such other business as may properly come before the Annual Meeting or any adjournments thereof.

The Board of Directors has fixed the close of business on November 2, 2021 as the record date for determining the shareholders entitled to notice of and to vote at the Annual Meeting and any adjournment and postponements thereof (the “Record Date”).

The Board of Directors believes that a favorable vote for each candidate for a position on the Board of Directors and for the ratification of Marcum LLP in Proposal 2 isproxy in the best interest of the Companymail, by completing, dating, signing and its shareholders and recommends a vote “FOR” all candidates and all other matters. Accordingly, we urge you to review the accompanying material carefully and to returnreturning the enclosed proxy, promptly. On the following pages, we provide answers to frequently asked questions about the Annual Meeting.

You are requested to read the enclosed proxy statement and to sign, date and return the accompanying proxy as soon as possible. This will assure your representation and a quorum for the transaction of business at the Annual Meeting.

| ||

| ||

| ||

|

Miami, FL

November 19, 2021

This proxy statement is dated November 19, 2021and is being mailed with the form of proxy on or shortly after November 22, 2021.

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

Meeting Date: December 16, 2021

To the Shareholders of Bull Horn Holdings Corp.:

NOTICE IS HEREBY GIVEN that the 2021 Annual General Meeting of Shareholders (the “Annual Meeting”) of Bull Horn Holdings Corp., a company incorporated in the British Virgin Islands, will be held virtually at 2:00 p.m. Eastern Time. You will be able to attend, vote your shares, and submit questions during the Annual Meeting via a live webcast available at https://www.cstproxy.com/bullhornse/2021. During the Annual Meeting, shareholders will be asked to:

(1) Elect four (4) “Class I” directors, namely, Michael Gandler, Jeff Wattenberg, Douglas Schaer and Baron Davis, each of whom will be elected for a two year term, or until the election and qualification of their successors;

(2) Ratify the appointment of Marcum LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021; and

(3) Transact any other business properly brought before the Annual Meeting or any adjournments thereof.

The Board of Directors has fixed the close of business on November 2, 2021, as the record date for determining the shareholders entitled to notice of, and to vote at, the Annual Meeting or any adjournments thereof. If you are a shareholder as of November 2, 2021, you may vote at the Annual Meeting, or any adjournment or postponement thereof. Each ordinary share entitles the holder thereof to one vote. The date of disseminating this Notice of Meeting and Proxy Statement is on or about November 22, 2021.

Your vote is important. Proxy voting permits shareholders unable to attend the Annual Meeting to vote their shares through a proxy. By appointing a proxy,so your shares will be represented and voted in accordance with your instructions. You can voteat the special meeting. Instructions on voting your shares by completing and returning your proxy card, or submit your proxy by telephone, fax, or over the Internet (if those options are available to you) in accordance with the instructions on the enclosed proxy card or voting instruction card. Proxy cards that are signed and returned but do not include voting instructions will be voted by the proxy as recommended by the Board of Directors. You can change your voting instructions or revoke your proxy at any time prior to the Annual Meeting by following the instructions included in this proxy statement and on the proxy card.

For a period of 10 days prior to the Annual Meeting, a shareholders list (as of the record datematerials you received for the Annual Meeting) will be kept at our office and shall be available for inspection by shareholders during usual business hours.

You are requested to read the enclosed proxy statement and to sign, date and return the accompanying proxy card as soon as possible. special meeting. Even if you plan to attend the Annual Meeting virtually,special meeting in person online, it is strongly recommended that you follow the procedures for voting bycomplete and return your proxy as described hereincard before the Annual Meetingspecial meeting date, to ensure that your shares will be represented at the Annual Meetingspecial meeting if you are unable to attend. ThisThe special meeting is to be held for the sole purpose of considering and voting upon the following proposals:

| ● | a proposal to amend Bull Horn’s amended and restated memorandum and articles of association (the “Amended and Restated Memorandum and Articles of Association”) to extend the date by which Bull Horn must consummate a business combination (the “Extension”) from November 3, 2022 to December 31, 2022 (such date or later date, as applicable, the “Extended Date”), by amending the Amended and Restated Memorandum and Articles of Association to delete the existing Regulation 23.2 thereof and replacing it with the new Regulation 23.2 in the form set forth in Annex A of the accompanying proxy statement (the “Extension Proposal”); and |

| ● | a proposal to direct the chairman of the special meeting to adjourn the special meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the special meeting, there are not sufficient votes to approve the Extension Proposal (the “Adjournment Proposal”). |

Each of the Extension Proposal and the Adjournment Proposal is more fully described in the accompanying proxy statement.

The purpose of the Extension Proposal and, if necessary, the Adjournment Proposal, is to allow Bull Horn more time to complete an initial business combination. Our Amended and Restated Memorandum and Articles of Association provide that Bull Horn has until November 3, 2022 to complete a business combination.

On April 18, 2022, Bull Horn entered into an Agreement and Plan of Merger (the “Merger Agreement”) with BH Merger Sub Inc., a Delaware corporation and wholly-owned subsidiary of Bull Horn (“Merger Sub”), and Coeptis Therapeutics, Inc., a Delaware corporation (“Coeptis”). Pursuant to the Merger Agreement, subject to the terms and conditions set forth therein, (i) prior to the Closing (as defined below), Bull Horn will assure your representationre-domicile from the British Virgin Islands to the State of Delaware through a statutory re-domestication (the “Domestication”), and (ii) upon the consummation of the transactions contemplated by the Merger Agreement (the “Closing”), Merger Sub will merge with and into Coeptis (the “Merger” and, together with the Domestication and the other transactions contemplated by the Merger Agreement, the “Transactions”), with Coeptis continuing as the surviving corporation in the Merger and a quorum forwholly-owned subsidiary of Bull Horn (after the transaction of business atDomestication). For additional information about the meeting.

| ||

| ||

| ||

|

IMPORTANT NOTICE REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON DECEMBER16, 2021:

This communication presents only an overview of the more complete proxy materials that are available to you on the Internet. We encourage you to access and review all of the important information contained in the proxy materials before voting.

The Notice, Proxy StatementMerger Agreement and the AnnualTransactions, please see the Current Report on Form 10-K for the fiscal year ended December 31, 2020 are available at https://www.cstproxy.com/bullhornse/2021. If you want to receive a paper or e-mail copy of these documents, you must request one. There is no charge to you for requesting a copy. Please make your request for a copy as instructed below on or before December 6, 2021 to facilitate timely delivery.

To request8-K filed by phone: (917) 262-2373

To request on the Internet: https://www.cstproxy.com/bullhornse/2021

If you have any questions about accessing materials or voting, please call Christopher Calise, the Company’s Chief Financial Officer, at (305) 671-3341.

| ||

| ||

| ||

| ||

| ||

|

| |

| ||

|

| |

| ||

| ||

|

i

On or about November 22, 2021, we are first disseminating to our shareholders of record and beneficial owners of ordinary shares of Bull Horn Holdings Corp. (which may be referred to in this proxy statement as “we,” “us,” “Bull Horn,” or the “Company”) this Notice and Proxy Statement in connection with the solicitation of proxies by our board of directors (“Board”) for our 2021 Annual General Meeting (the “Annual Meeting”) to be held on December 16, 2021, at 2:00 p.m. Eastern Time as a virtual meeting. Shareholders who received the notice will have the ability to access this proxy statement and the accompanying proxy card over the Internet. Our Board of Directors encourages you to read this document thoroughly and to take this opportunity to vote on the matters to be decided at the Annual Meeting. Instructions on how to access the proxy materials and vote over the Internet copy may be found in this Notice and Proxy Statement.

QUESTIONS AND ANSWERS ABOUT THE MEETING

Why did you send me this proxy statement?

This proxy statement and the enclosed proxy card are being sent to you in connection with the solicitation of proxies by the Board of the Company, for use at the Annual Meeting to be held on Thursday, December 16, 2021 at 2:00 p.m., Eastern Time, or at any adjournments or postponements thereof. This proxy statement summarizes the information that you need to make an informed decision on the proposals to be considered at the Annual Meeting. This proxy statement and the enclosed proxy card were first sent to the Company’s shareholders on or about November 22, 2021.

What is included in these materials?

These materials include:

• This Proxy Statement for the Annual Meeting; and

• The Company’s Annual Report on Form 10-K, as amended, for the year ended December 31, 2020, as filed with the Securities and Exchange Commission (the “SEC”) on July 28, 2021.

April 19, 2022 and What am I voting on?the proxy statement/prospectus included in the Form S-4 initially filed with the SEC on May 25, 2022, as amended or supplemented from time to time.

At this year’s meeting, you will

Bull Horn’s board of directors (“Board”) believes that there may not be asked to:

(1) Elect four (4) “Class I” directors (namely, Michael Gandler, Jeff Wattenberg, Douglas Schaer and Baron Davis), each of whom willsufficient time before November 3, 2022 to complete the Transactions. Accordingly, the Board believes that in order to be elected for a term of two years, or untilable to consummate the election and qualification of their successors;

(2) RatifyTransactions, we need to obtain the appointment of Marcum LLP asExtension. Therefore, our independent registered public accounting firm forBoard has determined that it is in the fiscal year ending December 31, 2021; and

(3) Transact any other business properly brought before the Annual Meeting or any adjournments thereof.

Who is entitled to vote at the Annual Meeting, and how many votes do they have?

Shareholders of record at the close of business on November 2, 2021 (the “Record Date”) may vote at the Annual Meeting. Pursuant to the rightsbest interests of our shareholders containedto extend the date by which Bull Horn must consummate a business combination to the Extended Date in order to provide our charter documents each ordinary share has one vote. There were 9,375,000shareholders with the opportunity to participate in the Transactions.

Holders (“public shareholders”) of Bull Horn’s ordinary shares outstanding on(“public shares”) sold in its initial public offering (“IPO”) may elect to redeem their public shares for their pro rata portion of the Recordfunds available in the trust account in connection with the Extension Proposal regardless of how such public shareholders vote in regard to those amendments. This right of redemption is provided for and is required by Bull Horn’s Amended and Restated Memorandum and Articles of Association and Bull Horn also believes that such redemption right protects Bull Horn’s public shareholders from having to sustain their investments for an unreasonably long period if Bull Horn fails to consummate an initial business combination by the Extended Date. From December 6, 2021 through December 15, 2021, you may inspect a listIf the Extension Proposal is approved by the requisite vote of shareholders eligible(and not abandoned), the remaining holders of public shares will retain their right to vote.redeem their public shares for their pro rata portion of the funds available in the trust account upon consummation of an initial business combination.

To exercise your redemption rights, you must tender your shares to the Company’s transfer agent at least two business days prior to the special meeting. You may tender your shares by either delivering your share certificates to the transfer agent or by delivering your shares electronically using the Depository Trust Company’s DWAC (Deposit/Withdrawal At Custodian) system. If you would like to inspect the list, please call Christopher Calise, the Company’s Chief Financial Officer, at (305) 671-3341.

1

How do I vote?

You may vote over the Internet or by mail. Please be aware that ifhold your shares in street name, you vote over the Internet, you may incur costs such as Internet access charges for which you will be responsible.

Vote by Internet. You can vote via the Internet at https://www.cstproxyvote.com. You will need to use the control number appearing on your proxy card to vote via the Internet. You can use the Internet to transmit your voting instructions up until 11:59 p.m. Eastern Time on December 15, 2021. Internet voting is available 24 hours a day. If you vote via the Internet, you do not need to return a proxy card.

Vote by Mail. You can vote by marking, dating and signing the enclosed proxy card, and returning it in the postage-paid envelope provided to Bull Horn Holdings Corp., 801 S. Pointe Drive, Suite TH-1, Miami Beach, Florida 33139. Please promptly mail your proxy card to ensure that it is received prior to the closing of the polls at the Annual Meeting.

If you vote by any of the methods discussed above, you will be designating Robert Striar, our Chief Executive Officer and Chairman of the Board, and Christopher Calise, our Chief Financial Officer, as your proxies, and they will vote your shares on your behalf as you indicate.

Submitting a proxy will not affect your right to attend the Annual Meeting virtually.

If your shares are held in the name of a bank, broker or other nominee, you will receive separate voting instructions frominstruct your bank, broker or other nominee describing howto withdraw the shares from your account in order to exercise your redemption rights.

Based upon the current amount in the trust account, Bull Horn estimates that the per-share pro rata portion of the trust account will be approximately $_____ at the time of the special meeting. The closing price of Bull Horn’s shares on ___________, 2022 was $_____. Bull Horn cannot assure shareholders that they will be able to sell their shares of Bull Horn in the open market, even if the market price per share is higher than the redemption price stated above, as there may not be sufficient liquidity in its securities when such shareholders wish to sell their shares.

The Adjournment Proposal, if adopted, will allow our Board to adjourn the special meeting to a later date or dates to permit further solicitation of proxies. The Adjournment Proposal will only be presented to our shareholders in the event that there are insufficient votes for, or otherwise in connection with, the approval of the Extension Amendment Proposal.

If the Extension Proposal is not approved and we do not consummate an initial business combination by November 3, 2022 in accordance with our Amended and Restated Memorandum and Articles of Association, or if the Extension Proposal is approved and we do not consummate an initial business combination by the Extended Date, we will cease all operations except for the purpose of winding up and as promptly as reasonably possible but not more than five business days thereafter, redeem 100% of the outstanding public shares with the aggregate amount then on deposit in the trust account.

The affirmative vote of the holders of at least 65% of the Company’s ordinary shares entitled to vote your shares. The availability of Internet voting will dependwhich are present (in person online or by proxy) at the special meeting and which vote on the voting processExtension Proposal will be required to approve the Extension Proposal.

The affirmative vote of your bank, broker or other nominee. Please check with your bank, broker or other nominee and follow the voting instructions it provides.

Can I receive future materials via the Internet?

If you vote by Internet, simply follow the prompts for enrolling in electronic proxy delivery service. This will reducea majority of the Company’s printingordinary shares entitled to vote which are present (in person online or by proxy) at the special meeting and postage costs inwhich vote on the future, as wellAdjournment Proposal will be required to approve the Adjournment Proposal.

Our Board has fixed the close of business on September 1, 2022 as the numberdate for determining the Bull Horn shareholders entitled to receive notice of paper documents you will receive.and vote at the special meeting and any adjournment thereof. Only holders of record of Bull Horn shares on that date are entitled to have their votes counted at the special meeting or any adjournment thereof.

What is a proxy?

A proxy is a person you appointYou are not being asked to vote on a business combination at this time. If the Extension is implemented and you do not elect to redeem your behalf. By usingpublic shares, provided that you are a shareholder on the methods discussed above,record date for a meeting to consider a business combination, you will be appointing each of Robert Striar, our Chief Executive Officerretain the right to vote on the business combination when it is submitted to shareholders and Chairmanthe right to redeem your public shares for a pro rata portion of the trust account in the event the business combination is approved and completed or the Company has not consummated a business combination by the Extended Date.

After careful consideration of all relevant factors, our Board has determined that the Extension Proposal and, Christopher Calise, our Chief Financial Officer, as your proxies. Eachif presented, the Adjournment Proposal are fair to and in the best interests of Bull Horn and its shareholders, has declared them willadvisable and recommends that you vote on your behalf,or give instruction to vote “FOR” the Extension Proposal and, will haveif presented, “FOR” the authority to appoint a substitute to act as proxy. IfAdjournment Proposal.

No other business shall be transacted at the special meeting.

Enclosed is the proxy statement containing detailed information concerning the Extension Proposal and the Adjournment Proposal and the special meeting. Whether or not you are unableplan to attend the Annual Meeting, pleasespecial meeting, we urge you to read this material carefully and vote byyour shares.

We look forward to seeing you at the meeting.

| ___________, 2022 | By Order of the Board of Directors |

| Robert Striar | |

| Chief Executive Officer and Chairman |

Your vote is important. Please sign, date and return your proxy socard as soon as possible to make sure that your ordinary shares may be voted.

What isare represented at the difference betweenspecial meeting. If you are a shareholder of record, and a beneficial owner of shares heldyou may also cast your vote in street name?

Shareholder of Record. If your shares are registered directly in your name withperson online at the Company’s transfer agent, Continental Stock Transfer & Trust Company, you are considered the shareholder of record with respect to those shares, and the proxy materials were sent directly to you by the Company.

Beneficial Owner of Shares Held in Street Name. special meeting. If your shares are held in an account at a brokerage firm or bank, broker-dealer, or other similar organization, then you are the beneficial owner of shares held in “street name,” and the proxy materials were forwarded to you by that organization. The organization holding your account is considered the shareholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right tomust instruct that organization on how to vote the shares held in your account. Those instructions are contained in a “vote instruction form.”

How will my proxy vote my shares?

If you are a shareholder of record, your proxy will vote according to your instructions. If you choose to vote by mail and complete and return the enclosed proxy card but do not indicate your vote, your proxy will vote “FOR” the election of the nominated slate of Class I directors (see Proposal 1) and “FOR” the ratification of Marcum LLP (“Marcum”) as our independent registered public accounting firm for the fiscal year ending December 31, 2021

2

(see Proposal 2). We do not intend to bring any other matter for a vote at the Annual Meeting, and we do not know of anyone else who intends to do so. Your proxies are authorized to vote on your behalf, however, using their best judgment, on any other business that properly comes before the Annual Meeting.

If your shares are held in the name of a bank, broker or other nominee, you will receive separate voting instructions from your bank, broker or other nominee describing how to vote your shares. The availability of Internet voting will depend on the voting process of your bank, broker or other nominee. Please check with your bank, broker or other nominee and follow the voting instructions your bank, broker or other nominee provides.

You should instruct your bank, broker or other nominee how to vote your shares. If you do not give voting instructions to the bank, broker or other nominee, the bank, broker or other nominee will determine if it has the discretionary authority to vote on the particular matter. Under applicable rules, brokers have the discretion to vote on routine matters, such as the ratification of the selection of accounting firms, but do not have discretion to vote on non-routine matters. Under the regulations applicable to New York Stock Exchange member brokerage firms (many of whom are the record holders of our ordinary shares), the uncontested election of directors is no longer considered a routine matter. Matters related to executive compensation are also not considered routine. As a result, if you are a beneficial owner and hold your shares in street name, but do not give your broker or other nominee instructions onbank how to vote your shares, with respect to these matters, votesor you may not be cast on your behalf. Ifvote in person online at the special meeting by obtaining a proxy from your bank, brokerbrokerage firm or other nominee indicates on its proxy card that it does not have discretionary authority to vote on a particular proposal, your shares will be consideredbank.

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting of Shareholders to be “broker non-votes” with regard to that matter. Broker non-votes will be counted as present for purposesheld on ___________, 2022: This notice of determining whether enough votes are present to hold our Annual Meeting, but a broker non-vote will not otherwise affect the outcome of a vote on a non-routine matter that requires a majority of the votes of shares present in person or represented by proxy and entitled to vote. With respect to a non-routine matter that requires a favorable vote of a majority of the outstanding shares, a broker non-vote has the same effect as a vote against the proposal. With regard to the proposals for this Annual Meeting, the election of directors is “non-routine”meeting and the ratification of auditors is “routine.” In tabulating the voting result for the election of directors, shares that constitute broker non-votes and abstentionsaccompanying proxy statement are not considered votes cast. In tabulating the voting results for the ratification of auditors, abstentions are not considered as votes cast and broker non-votes are considered votes cast.available at https://www.cstproxy.com/___________.

How do I change my vote?

If you are a shareholder of record, you may revoke your proxy at any time before your shares are voted at the Annual Meeting by:

• Notifying our Chief Financial Officer, in writing at BULL HORN HOLDINGS CORP.

801 S. Pointe Drive, Suite TH-1, Miami Beach, FloridaPOINTE DRIVE, SUITE TH-1

MIAMI BEACH, FLORIDA 33139 that you are revoking your proxy; or

• Submitting a proxy at a later date via the Internet, or by signing and delivering a proxy card relating to the same shares and bearing a later date than the date of the previous proxy prior to the vote at the Annual Meeting, in which case your later-submitted proxy will be recorded and your earlier proxy revoked.

If your shares are held in the name of a bank, broker or other nominee, you should check with your bank, broker or other nominee and follow the voting instructions provided.SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON ___________, 2022

PROXY STATEMENT

What constitutes a quorum?

The holdersspecial meeting (the “special meeting”) of a majority of the Company’s eligible votes as of the Record Date, either present or represented by proxy, constitute a quorum. A quorum is necessary in order to conduct the Annual Meeting. If you choose to have your shares represented by proxy at the Annual Meeting, you will be considered part of the quorum. Both abstentions and broker non-votes are counted as present for the purpose of determining the presence of a quorum. If a quorum is not present at the Annual Meeting, the Chairman of the Board may adjourn the meeting to a later date.

What vote is required to approve each proposal?

Election of Directors and Ratification of the Appointment of Independent Registered Public Accounting Firm. For Proposals 1 and 2, it will require the affirmative vote of a majority of the votes of the ordinary shares entitled to vote thereon which were present virtually or represented by proxy and were voted at the Annual Meeting. You may choose to vote, or withhold your vote, separately for each nominee. A properly executed proxy or voting

3

instructions marked “WITHHOLD” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated, although it will be counted for the purposes of determining whether there is a quorum.

Other Proposals. Any other proposal that might properly come before the meeting will also require the affirmative vote of a majority of the votes of the ordinary shares entitled to vote thereon which were present virtually or represented by proxy and were voted at the Annual Meeting for the proposal to be approved, except when a different vote is required by law and/or our memorandum and articles of association, or when the proposal seeks to amend or vary the rights of the ordinary shares (unless such amendment or variation is for the purposes or approving, or in conjunction with, the consummation of a business combination). On any such proposal, abstentions will be counted as present and entitled to vote on that matter for purposes of establishing a quorum, but will not be counted for purposes of determining the number of votes cast.

Abstentions and broker non-votes with respect to any matter will be counted as present and entitled to vote on that matter for purposes of establishing a quorum. Abstentions will not be counted for purposes of determining the number of votes cast and accordingly will have no effect on the outcome of voting with respect to any of the proposals for this Annual Meeting.

What percentage of our ordinary shares do our directors and officers own?

As of the Record Date, our current directors and executive officers beneficially owned approximately 20% of our ordinary shares outstanding. See the discussion under the heading “Security Ownership of Certain Beneficial Owners and Management” on page 20 for more details.

Who is soliciting proxies, how are they being solicited, and who pays the cost?

We, on behalf of our Board, through our directors, officers, and employees, are soliciting proxies primarily by mail. Further, proxies may also be solicited in person, by email. We will pay the cost of soliciting proxies. We will also reimburse stockbrokers and other custodians, nominees, and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to the owners of our ordinary shares.

Is my vote kept confidential?

Proxies, ballots and voting tabulations identifying stockholders are kept confidential and will not be disclosed except as may be necessary to meet legal requirements.

Who is our Independent Registered Public Accounting Firm, and will they be represented at the Annual Meeting?

Marcum has served as the independent registered public accounting firm auditing and reporting on our financial statements for the fiscal years ended December 31, 2019 and 2020. Marcum has been appointed by our Board to serve as our independent registered public accounting firm for the fiscal year ended December 31, 2021. We expect that representatives of Marcum will not be present at the Annual Meeting.

What are the recommendations of our Board?

The recommendations of our Board are set forth together with the description of each proposal of this proxy statement. In summary, the Board recommends a vote:

• FOR the election of the four nominated Class I directors (Michael Gandler, Jeff Wattenberg, Douglas Schaer and Baron Davis) (see Proposal 1); and

• FOR the ratification of Marcum LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021 (see Proposal 2).

With respect to any other matter that properly comes before the meeting, the proxy holders will vote as recommended by the Board or, if no recommendation is given, in their own discretion.

4

If you sign and return your proxy card but do not specify how you want to vote your shares, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Board.

Who is the sponsor of the Company?

References throughout this proxy statement to our “sponsor” are to Bull Horn Holdings Sponsor LLC, a Delaware limited liability company. Robert Striar, our Chief Executive Officer and Chairman of the Board, and Christopher Calise, our Chief Financial Officer, who, as managing members, and certain of our directors, through their ownership of membership interests, share control of our sponsor.

Who can help answer my questions?

You can contact our Chief Financial Officer, Christopher Calise at ccalise@bullhornse.com or by sending a letter to Mr. Calise at the offices of the Company at 801 S. Pointe Drive, Suite TH-1, Miami Beach, Florida 33139 with any questions about the proposals described in this proxy statement or how to execute your vote.

5

THE ANNUAL MEETING

We are furnishing this proxy statement to you as a shareholdershareholders of Bull Horn Holdings Corp. as part of the solicitation of proxies by our Board for use at our virtual Annual Meeting to be held on Thursday, December 16, 2021,(“Bull Horn,” “Company,” “we,” “us” or any adjournment or postponement thereof.

Date, Time, Place and Purpose of the Annual Meeting

The Annual Meeting“our”), a British Virgin Islands business company, will be held on Thursday, December 16, 2020, at 2:10:00 p.m.,a.m. Eastern Time on ___________, 2022, as a virtual meeting. You will be able to attend, vote your shares, and submit questions during the Annual Meetingspecial meeting via a live webcast available at https://www.cstproxy.com/bullhornse/2021___________, for the sole purpose of considering and voting upon the following proposals:

| ● | a proposal to amend Bull Horn’s amended and restated memorandum and articles of association (the “Amended and Restated Memorandum and Articles of Association”) to extend the date by which Bull Horn must consummate a business combination (the “Extension”) from November 3, 2022 to December 31, 2022 (such date or later date, as applicable, the “Extended Date”), by amending the Amended and Restated Memorandum and Articles of Association to delete the existing Regulation 23.2 thereof and replacing it with the new Regulation 23.2 in the form set forth in Annex A of the accompanying proxy statement (the “Extension Proposal”); and |

| ● | a proposal to direct the chairman of the special meeting to adjourn the special meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the special meeting, there are not sufficient votes to approve the Extension Proposal (the “Adjournment Proposal”). |

The Extension Proposal is essential to the overall implementation of the plan of our board of directors (the “Board”) to extend the date that Bull Horn must complete an initial business combination. The purpose of the Extension Proposal and, if necessary, the Adjournment Proposal, is to allow Bull Horn more time to complete an initial business combination. Our Amended and Restated Memorandum and Articles of Association provide that Bull Horn has until November 3, 2022 to complete an initial business combination.

On April 18, 2022, Bull Horn entered into an Agreement and Plan of Merger (the “Merger Agreement”) with BH Merger Sub Inc., a Delaware corporation and wholly-owned subsidiary of Bull Horn (“Merger Sub”), and Coeptis Therapeutics, Inc., a Delaware corporation (“Coeptis”). Pursuant to the Merger Agreement, subject to the terms and conditions set forth therein, (i) prior to the Closing (as defined below), Bull Horn will re-domicile from the British Virgin Islands to the State of Delaware through a statutory re-domestication (the “Domestication”), and (ii) upon the consummation of the transactions contemplated by the Merger Agreement (the “Closing”), Merger Sub will merge with and into Coeptis (the “Merger” and, together with the Domestication and the other transactions contemplated by the Merger Agreement, the “Transactions”), with Coeptis continuing as the surviving corporation in the Merger and a wholly-owned subsidiary of Bull Horn (after the Domestication). For additional information about the Merger Agreement and the Transactions, please see the Current Report on Form 8-K filed by Bull Horn with the Securities and Exchange Commission (the “SEC”) on April 19, 2022 and the proxy statement/prospectus included in the Form S-4 initially filed with the SEC on May 25, 2022, as amended or supplemented from time to time.

Our Board believes that there may not be sufficient time before November 3, 2022 to complete the Transactions. Accordingly, the Board believes that in order to be able to consummate the Transactions, we need to obtain the Extension. Therefore, our Board has determined that it is in the best interests of our shareholders to extend the date by which Bull Horn must consummate a business combination to the Extended Date in order to provide our shareholders with the opportunity to participate in the Transactions.

The affirmative vote of the holders of at least 65% of the Company’s ordinary shares entitled to vote which are present (in person online or by proxy) at the special meeting and which vote on the Extension Proposal will be required to approve the Extension Proposal. The affirmative vote of a majority of the Company’s ordinary shares entitled to vote which are present (in person online or by proxy) at the special meeting and which vote on the Adjournment Proposal will be required to approve the Adjournment Proposal.

In connection with the Extension Proposal, holders (“public shareholders”) of Bull Horn’s ordinary shares sold in its IPO (“public shares”) may elect to redeem their public shares for their pro rata portion of the funds available in the trust account in connection with the Extension Proposal (the “Election”) regardless of how such public shareholder votes in regard to the Extension Proposal. Bull Horn believes that such redemption right protects Bull Horn’s public shareholders from having to sustain their investments for an unreasonably long period if Bull Horn fails to complete its initial business combination in the timeframe initially contemplated by its Amended and Restated Memorandum and Articles of Association. If the Extension Proposal is approved and implemented, the remaining public shareholders will retain their right to redeem their public shares for their pro rata portion of the funds available in the trust account in connection with any meeting to approve an initial business combination.

To exercise your redemption rights, you must tender your shares to the Company’s transfer agent at least two business days prior to the special meeting. You may tender your shares by either delivering your share certificates to the transfer agent or by delivering your shares electronically using the Depository Trust Company’s DWAC (Deposit/Withdrawal At Custodian) system. If you hold your shares in street name, you will need to instruct your bank, broker or other nominee to withdraw the shares from your account in order to exercise your redemption rights.

If the Extension Proposal is approved, such approval will constitute consent for the Company to (i) remove from the trust account an amount (the “Withdrawal Amount”) equal to the number of public shares properly redeemed in connection with the shareholder vote on the Extension Proposal multiplied by the per-share price equal to the aggregate amount then on deposit in the trust account as of two business days prior to the special meeting, including interest earned on the trust account deposits (which interest shall be net of taxes payable), divided by the number of then outstanding public shares and (ii) deliver to the holders of such redeemed public shares their portion of the Withdrawal Amount. The remainder of such funds shall remain in the trust account and be available for use by the Company to complete a business combination on or before the Extended Date. Holders of public shares who do not redeem their public shares now will retain their redemption rights and their ability to vote on a business combination through the Extended Date if the Extension Proposal is approved.

The removal of the Withdrawal Amount from the trust account in connection with the Election will reduce the amount held in the trust account following the redemption, and the amount remaining in the trust account may be significantly reduced from the approximately $33.0 million that was in the trust account as of June 30, 2022. In such event, Bull Horn may need to obtain additional funds to complete a business combination and there can be no assurance that such funds will be available on terms acceptable to the parties or at all.

If the Extension Proposal is not approved and we do not consummate a business combination by November 3, 2022, as contemplated by our IPO prospectus and in accordance with our Amended and Restated Memorandum and Articles of Association, we will, as promptly as reasonably possible but not more than five business days thereafter, distribute the aggregate amount then on deposit in the trust account (net of taxes payable, and less up to $50,000 of interest to pay liquidation expenses), pro rata to our public shareholders by way of redemption and cease all operations except for the purposes of winding up of our affairs by way of a voluntary liquidation, as further described herein. Any redemption of public shareholders from the trust account shall be effected as required by our Amended and Restated Memorandum and Articles of Association prior to our commencing any voluntary liquidation. If we are required to liquidate prior to distributing the aggregate amount then on deposit in the trust account (net of taxes payable, and less up to $50,000 of interest to pay liquidation expenses) pro rata to our public shareholders, then such winding up, liquidation and distribution must comply with the applicable provisions of the BVI Business Companies Act of 2004 (as amended). In that case, investors may be forced to wait beyond November 3, 2022 before the proceeds of our trust account become available to them, and they receive the return of their pro rata portion of the proceeds from our trust account. Except as otherwise described herein, we have no obligation to return funds to investors prior to the date of any redemption required as a result of our failure to consummate our initial business combination within the period described above or our liquidation, unless we consummate our initial business combination prior thereto and only then in cases where investors have sought to redeem their ordinary shares. Only upon any such redemption of public shares as we are required to effect or any liquidation will public shareholders be entitled to distributions if we are unable to complete our initial business combination.

Our initial shareholders have waived their rights to participate in any liquidation distribution with respect to their founder shares. As a consequence of such waivers, a liquidating distribution will be made only with respect to the public shares. There will be no distribution from the trust account with respect to Bull Horn’s warrants, which will expire worthless in the event we wind up.

You are cordially invitedalso being asked to attenddirect the chairman of the special meeting to adjourn the special meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the special meeting, there are not sufficient votes to approve the Extension Proposal.

The record date for the special meeting is September 1, 2022. Record holders of Bull Horn ordinary shares at the close of business on the record date are entitled to vote or have their votes cast at the special meeting. On the record date, there were 5,116,414 outstanding ordinary shares of Bull Horn, including 3,241,414 outstanding public shares. Bull Horn’s warrants do not have voting rights.

This proxy statement contains important information about the special meeting and the proposals. Please read it carefully and vote your shares.

This proxy statement is dated ___________, 2022 and is first being mailed to shareholders on or about that date.

TABLE OF CONTENTS

i

BULL HORN HOLDINGS CORP.

801 S. POINTE DRIVE, SUITE TH-1

MIAMI BEACH, FLORIDA 33139

SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON ___________, 2022

PROXY STATEMENT

QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING

These Questions and Answers are only summaries of the matters they discuss. They do not contain all of the information that may be important to you. You should read carefully the entire document, including the annexes to this proxy statement.

| Q. Why am I receiving this proxy statement? | A. This proxy statement and the accompanying materials are being sent to you in connection with the solicitation of proxies by the Board, for use at the special meeting of shareholders to be held on ___________, 2022, at 10:00 a.m., Eastern Time, as a virtual meeting, or at any adjournments or postponements thereof. This proxy statement summarizes the information that you need to make an informed decision on the proposals to be considered at the special meeting. | |

Bull Horn is a blank check company formed in November 2018 for the purpose of acquiring, engaging in a share exchange, share reconstruction and amalgamation with, purchasing all or substantially all of the assets of, entering into contractual arrangements with, or engaging in any other similar business combination with one or more businesses or entities. On November 3, 2020, we consummated our IPO of 7,500,000 units at a price of $10.00 per unit, generating gross proceeds of $75,000,000. Simultaneously with the closing of the IPO, we consummated the private sale of 3,750,000 warrants (the “private placement warrants”) to our sponsor and the underwriters of our IPO at a price of $1.00 per private placement warrant, generating gross proceeds of $3,750,000. A total of $75,750,000 was placed in the trust account upon the closing of the IPO. Like most blank check companies, our Amended and Restated Memorandum and Articles of Association provides for the return of the IPO proceeds held in trust to the public shareholders if there is no qualifying business combination consummated on or before a certain date. On April 26, 2022, we held a special meeting of our shareholders. At the special meeting, our shareholders approved an amendment to our Amended and Restated Memorandum and Articles of Association to extend the date by which we must consummate our initial business combination from May 3, 2022 to November 3, 2022. On April 27, 2022, we filed an amended and restated copy of the Amended and Restated Memorandum and Articles of Association with the Registrar of Corporate Affairs of the British Virgin Islands, effective the same day. In connection with the special meeting, shareholders holding 4,258,586 public shares exercised their right to redeem their shares for a pro rata portion of the funds in the trust account. As a result, approximately $43.0 million (approximately $10.10 per public share) was removed from the trust account immediately after the redemption to pay such holders and approximately $33.0 million remained in the trust account as of June 30, 2022. Following redemptions, we have 3,241,414 public shares outstanding and the sponsor agreed to lend us $66,667 (or approximately $0.02 per public share that remains outstanding) per month to deposit into the trust account in connection with the extension of our termination date from May 3, 2022 to November 3, 2022. On May 2, 2022, we issued a promissory note to the sponsor in connection with such loan, which bears no interest and is repayable in full upon the earlier of (a) the date of the consummation of our initial business combination, or (b) the date of our liquidation. If the initial business combination is not consummated by November 3, 2022, then our existence will terminate, and we will distribute all amounts in the trust account. On April 18, 2022, Bull Horn entered into the Merger Agreement with Merger Sub and Coeptis. Pursuant to the Merger Agreement, subject to the terms and conditions set forth therein, (i) prior to the Closing, Bull Horn will re-domicile from the British Virgin Islands to the State of Delaware through a statutory re-domestication, and (ii) upon the Closing, Merger Sub will merge with and into Coeptis, with Coeptis continuing as the surviving corporation in the Merger and a wholly-owned subsidiary of Bull Horn (after the Domestication). For additional information about the Merger Agreement and the Transactions, please see the Current Report on Form 8-K filed by Bull Horn with the SEC on April 19, 2022 and the proxy statement/prospectus included in the Form S-4 initially filed with the SEC on May 25, 2022, as amended or supplemented from time to time. The Board believes that it is in the best interests of the shareholders to continue Bull Horn’s existence until the Extended Date in order to allow Bull Horn more time to complete the Transactions. |

| Q. What is being voted on? | A. You are being asked to vote on: | |

| ● a proposal to amend Bull Horn’s Amended and Restated Memorandum and Articles of Association to extend the date by which Bull Horn must consummate a business combination from November 3, 2022 to December 31, 2022 (such date or later date, as applicable, the “Extended Date”), by amending the Amended and Restated Memorandum and Articles of Association to delete the existing Regulation 23.2 thereof and replacing it with the new Regulation 23.2 in the form set forth in Annex A of the accompanying proxy statement; and | ||

| ● a proposal to direct the chairman of the special meeting to adjourn the special meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the special meeting, there are not sufficient votes to approve the Extension Proposal. | ||

| The Extension Proposal is essential to the overall implementation of our Board’s plan to extend the date by which we have to complete an initial business combination. Approval of the Extension Proposal is a condition to the implementation of the Extension. | ||

| You are also being asked to direct the chairman of the special meeting to adjourn the special meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the special meeting, there are not sufficient votes to approve the Extension Proposal. | ||

| Q. Why is the Company proposing the Extension Proposal? | A. Bull Horn’s Amended and Restated Memorandum and Articles of Association provides for the return of the IPO proceeds held in trust to public shareholders if there is no qualifying business combination consummated on or before November 3, 2022. Our Board believes that it is in the best interests of the shareholders to continue our existence until the Extended Date in order to allow us more time to complete an initial business combination. | |

| The purpose of the Extension Proposal and, if necessary, the Adjournment Proposal, is to allow us additional time to complete an initial business combination. |

| Q. Why should I vote for the Extension Proposal? | A. While we are using our best efforts to complete the Transactions as soon as practicable, the Board believes that there may not be sufficient time before November 3, 2022 to complete the Transactions. Accordingly, the Board believes that in order to be able to consummate the Transactions, we will need to obtain the Extension. Without the Extension, the Board believes that there is significant risk that we might not, despite our best efforts, be able to complete the Transactions on or before November 3, 2022. If that were to occur, we would be precluded from completing the Transactions and would be forced to liquidate even if our shareholders are otherwise in favor of consummating the Transactions. Accordingly, our Board is proposing the Extension Proposal to extend the date by which Bull Horn must complete a business combination until the Extended Date and to allow for the Election. | |

| Bull Horn’s Amended and Restated Memorandum and Articles of Association require the affirmative vote of the holders of at least 65% of the Company’s ordinary shares which are present (in person online or by proxy) and which vote at the special meeting in order to effect an amendment to certain of its provisions, including any amendment that would extend its corporate existence beyond November 3, 2022, except in connection with, and effective upon consummation of, a business combination. Additionally, Bull Horn’s Amended and Restated Memorandum and Articles of Association and Trust Agreement require that all public shareholders have an opportunity to redeem their public shares in the case Bull Horn’s corporate existence is extended as described above. We believe that these Amended and Restated Memorandum and Articles of Association provisions were included to protect Bull Horn shareholders from having to sustain their investments for an unreasonably long period if Bull Horn failed to complete the Transactions in the timeframe contemplated by the Amended and Restated Memorandum and Articles of Association. We also believe, however, that given the pending Transactions, circumstances warrant providing those who would like to consider whether the Transactions are an attractive investment with an opportunity to consider such Transactions, inasmuch as Bull Horn is also affording shareholders who wish to redeem their public shares the opportunity to do so, as required under its Amended and Restated Memorandum and Articles of Association. Accordingly, we believe the Extension is consistent with Bull Horn’s Amended and Restated Memorandum and Articles of Association and IPO prospectus. | ||

| Q. How do the Bull Horn insiders intend to vote their shares? | A. All of Bull Horn’s directors, executive officers, initial shareholders and their respective affiliates are expected to vote any ordinary shares over which they have voting control (including any public shares owned by them) in favor of the Extension Proposal and the Adjournment Proposal. | |

| Bull Horn’s directors, executive officers, initial shareholders and their respective affiliates are not entitled to redeem any shares owned by them. On the record date, Bull Horn’s directors, executive officers, initial shareholders and their affiliates beneficially owned and were entitled to vote an aggregate of 1,875,000 ordinary shares, representing approximately 36.3% of Bull Horn’s issued and outstanding ordinary shares. |

| Bull Horn’s directors, executive officers, initial shareholders and their affiliates may choose to buy public shares in the open market and/or through negotiated private purchases. In the event that purchases do occur, the purchasers may seek to purchase shares from shareholders who would otherwise have voted against the Extension Proposal. Any public shares held by or subsequently purchased by affiliates of Bull Horn may be voted in favor of the Extension Proposal. |

| Q. What vote is required to adopt the Extension Proposal? | A. Pursuant to Bull Horn’s Amended and Restated Memorandum and Articles of Association, approval of the Extension Proposal will require the affirmative vote of at least 65% of the Company’s ordinary shares entitled to vote which are present (in person online or by proxy) at the special meeting and which vote on the Extension Proposal. Abstentions will have no effect with respect to approval of this proposal. | |

| Q. What vote is required to approve the Adjournment Proposal? | A. The affirmative vote of a majority of the Company’s ordinary shares entitled to vote and which are present (in person online or by proxy) at the special meeting and which vote will be required to direct the chairman to adjourn the special meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the special meeting, there are not sufficient votes to approve the Extension Proposal. Abstentions will have no effect with respect to approval of this proposal. | |

| If your shares are held by your broker as your nominee (that is, in “street name”), you may need to obtain a proxy form from the institution that holds your shares and follow the instructions included on that form regarding how to instruct your broker to vote your shares. If you do not give instructions to your broker, your broker can vote your shares with respect to “discretionary” items, but not with respect to “non-discretionary” items. Discretionary items are proposals considered routine under the rules of the New York Stock Exchange applicable to member brokerage firms. These rules provide that for routine matters your broker has the discretion to vote shares held in street name in the absence of your voting instructions. On non-discretionary items for which you do not give your broker instructions, the shares will be treated as broker non-votes. We believe that each of the proposals are “non-discretionary” items. | ||

| Q. What if I don’t want to vote for the Extension Proposal? | A. If you do not want the Extension Proposal to be approved, you should vote against the Extension Proposal. If the Extension Proposal is approved, and the Extension is implemented, and you have exercised your redemption rights then the Withdrawal Amount will be withdrawn from the trust account and paid to you and the other redeeming public shareholders. | |

| Q. Will you seek any further extensions to liquidate the trust account? | A. Other than the extension until the Extended Date as described in this proxy statement, Bull Horn does not anticipate, but is not prohibited from, seeking the requisite shareholder consent to any further extension to consummate a business combination. Bull Horn has provided that all holders of public shares, whether they vote for or against the Extension Proposal, may elect to redeem their public shares into their pro rata portion of the trust account and should receive the funds shortly after the special meeting. Those holders of public shares who elect not to redeem their shares now shall retain redemption rights with respect to the initial business combination, or, if no future business combination is brought to a vote of the shareholders or if a business combination is not completed for any reason, such holders shall be entitled to the pro rata portion of the trust account on the Extended Date upon a liquidation of the Company. | |

| Q. What happens if the Extension Proposal is not approved? | A. If the Extension Proposal is not approved and we have not consummated a business combination by November 3, 2022, or if the Extension Proposal is approved and we have not consummated a business combination by the Extended Date, we will (i) cease all operations except for the purpose of winding up, (ii) as promptly as reasonably possible but not more than five business days thereafter, redeem 100% of the outstanding public shares which redemption will completely extinguish public shareholders’ rights as shareholders (including the right to receive further liquidation distributions, if any), subject to applicable law, and (iii) as promptly as reasonably possible following such redemption, subject to the approval of our remaining holders of ordinary shares and our board of directors, proceed to commence a voluntary liquidation and thereby a formal dissolution of the company, subject (in the case of (ii) and (iii) above) to our obligations to provide for claims of creditors and the requirements of applicable law. In connection with our redemption of 100% of our outstanding public shares for a portion of the funds held in the trust account, each public shareholder will receive a full pro rata portion of the amount then in the trust account, plus any pro rata interest earned on the funds held in the trust account and not previously released to us to pay our taxes payable on such funds. |

| The initial shareholders have waived their rights to participate in any liquidation distribution with respect to their founder shares or the ordinary shares included in the private placement warrants. There will be no distribution from the trust account with respect to our warrants, which will expire worthless in the event we wind up. | ||

| Q. If the Extension Proposal is approved, what happens next? | A. If the Extension Proposal is approved, we will have until the Extended Date to complete an initial business combination. | |

| If the Extension Proposal is approved, we will, pursuant to that certain Investment Management Trust Agreement (the “Trust Agreement”) between us and Continental Stock Transfer & Trust Company, remove the Withdrawal Amount from the trust account, deliver to the holders of redeemed public shares their portion of the Withdrawal Amount and retain the remainder of the funds in the trust account for our use in connection with consummating an initial business combination on or before the Extended Date. | ||

| We will not implement the Extension if we would not have at least $5,000,001 of net tangible assets following approval of the Extension Proposal after taking into account the Election. | ||

| If the Extension Proposal is approved and the Extension is implemented, the removal of the Withdrawal Amount from the trust account in connection with the Election will reduce the amount held in the trust account following the Election and increase the percentage interest of Bull Horn’s ordinary shares held by Bull Horn’s officers, directors, initial shareholders and their affiliates. We cannot predict the amount that will remain in the trust account if the Extension Proposal is approved and the amount remaining in the trust account may be only a small fraction of the approximately $33.0 million that was in the trust account as of June 30, 2022. In such event, we may need to obtain additional funds to complete an initial business combination, and there can be no assurance that such funds will be available on terms acceptable to the parties or at all. The Company will remain a reporting company under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and its units, ordinary shares and warrants will remain publicly traded. | ||

| Q. Who bears the cost of soliciting proxies? | A. The Company will bear the cost of soliciting proxies and will reimburse brokerage firms and others for expenses involved in forwarding proxy materials to beneficial owners or soliciting their execution. In addition to solicitations by mail, the Company, through its directors and officers, may solicit proxies in person online, by telephone or by electronic means. Such directors and officers will not receive any special remuneration for these efforts. We have retained Advantage Proxy, Inc. (“Advantage Proxy”) to assist us in soliciting proxies. If you have questions about how to vote or direct a vote in respect of your shares, you may contact Advantage Proxy at (877) 870-8565 (toll free) or by email at ksmith@advantageproxy.com. The Company has agreed to pay Advantage Proxy a fee of $7,500 and expenses, for its services in connection with the special meeting. |

| Q. How do I change my vote? | A. If you have submitted a proxy to vote your shares and wish to change your vote, you may do so by delivering a later-dated, signed proxy card to Bull Horn’s Chief Executive Officer prior to the date of the special meeting or by voting in person online at the special meeting. Attendance at the special meeting alone will not change your vote. You also may revoke your proxy by sending a notice of revocation to Bull Horn located at 801 S. Pointe Drive, Suite TH-1, Miami Beach, Florida 33139, Attn: Chief Executive Officer. | |

| Q. If my shares are held in “street name,” will my broker automatically vote them for me? | A. No. If you do not give instructions to your broker, your broker can vote your shares with respect to “discretionary” items, but not with respect to “non-discretionary” items. We believe that each of the proposals are “non-discretionary” items. | |

| Your broker can vote your shares with respect to “non-discretionary items” only if you provide instructions on how to vote. You should instruct your broker to vote your shares. Your broker can tell you how to provide these instructions. If you do not give your broker instructions, your shares will be treated as broker non-votes with respect to all proposals and will have no effect on the outcome of any vote. | ||

| Q. What is a quorum requirement? | A. A quorum of shareholders is necessary to hold a valid meeting. A quorum will be present for the special meeting if there are present in person or by proxy not less than 50% of the Company’s ordinary shares present at the meeting in person online or by proxy. Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you attend the special meeting in person online. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the chairman of the special meeting may adjourn the special meeting to another date. | |

| Q. Who can vote at the special meeting? | A. Only holders of record of Bull Horn’s ordinary shares at the close of business on September 1, 2022 are entitled to have their vote counted at the special meeting and any adjournments or postponements thereof. On this record date, 5,116,414 ordinary shares were outstanding and entitled to vote. | |

| Shareholder of Record: Shares Registered in Your Name. If on the record date your shares were registered directly in your name with Bull Horn’s transfer agent, Continental Stock Transfer & Trust Company, then you are a shareholder of record. As a shareholder of record, you may vote in person online at the special meeting or vote by proxy. Whether or not you plan to attend the special meeting in person online, we urge you to fill out and return the enclosed proxy card to ensure your vote is counted. | ||

| Beneficial Owner: Shares Registered in the Name of a Broker or Bank If on the record date your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the special meeting virtually. However, since you are not the shareholder of record, you may not vote your shares in person online at the special meeting unless you request and obtain a valid proxy from your broker or other agent. |

| Q. Does the Board recommend voting for the approval of the Extension Proposal? | A. Yes. After careful consideration of the terms and conditions of these proposals, the Board has determined that the Extension Proposal is fair to and in the best interests of Bull Horn and its shareholders. The Board recommends that Bull Horn’s shareholders vote “FOR” the Extension Proposal and “FOR” the Adjournment Proposal, if presented. | |

| Q. What interests do the Company’s directors and officers have in the approval of the proposals? | A. Bull Horn’s current and former directors, officers, initial shareholders and their affiliates have interests in the proposals that may be different from, or in addition to, your interests as a shareholder. These interests include ownership of certain securities of the Company. See the section entitled “The Extension Proposal — Interests of Bull Horn’s Directors and Officers.” | |

| Q. What happens to the Bull Horn warrants if the Extension Proposal is not approved? | A. If the Extension Proposal is not approved, we will automatically wind up, liquidate and dissolve effective starting on November 3, 2022. In such event, your warrants will become worthless. |

| Q. What happens to the Bull Horn warrants if the Extension Proposal is approved? | A. If the Extension Proposal is approved, Bull Horn will continue to attempt to consummate an initial business combination until the Extended Date, and will retain the blank check company restrictions previously applicable to it. The warrants will remain outstanding in accordance with their terms. | |

| Q. What do I need to do now? | A. Bull Horn urges you to read carefully and consider the information contained in this proxy statement, including the annex and to consider how the proposals will affect you as a Bull Horn shareholder. You should then vote as soon as possible in accordance with the instructions provided in this proxy statement and on the enclosed proxy card. | |

| Q. How do I vote? | A. If you are a holder of record of Bull Horn public shares, you may vote in person online at the special meeting or by submitting a proxy for the special meeting. Whether or not you plan to attend the special meeting in person online, we urge you to vote by proxy to ensure your vote is counted. You may submit your proxy by completing, signing, dating and returning the enclosed proxy card in the accompanying pre-addressed postage paid envelope. You may still attend the special meeting and vote in person online if you have already voted by proxy. | |

| If your shares of Bull Horn are held in “street name” by a broker or other agent, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the special meeting. However, since you are not the shareholder of record, you may not vote your shares in person online at the special meeting unless you request and obtain a valid proxy from your broker or other agent. | ||

| Q. How do I exercise my redemption rights? | A. If the Extension is implemented, each public shareholder may seek to redeem such shareholder’s public shares for its pro rata portion of the funds available in the trust account, less any income taxes owed on such funds but not yet paid. You will also be able to redeem your public shares in connection with any shareholder vote to approve a proposed business combination, or if the Company has not consummated a business combination by the Extended Date. | |

| In connection with tendering your shares for redemption, you must elect either to physically tender your share certificates to Continental Stock Transfer & Trust Company, the Company’s transfer agent, at Continental Stock Transfer & Trust Company, One State Street Plaza, 30th Floor, New York, New York 10004-1561, Attn: Mark Zimkind, mzimkind@continentalstock.com, at least two business days prior to the special meeting or to deliver your shares to the transfer agent electronically using The Depository Trust Company’s DWAC System, which election would likely be determined based on the manner in which you hold your shares. | ||

| Certificates that have not been tendered in accordance with these procedures at least two business days prior to the special meeting will not be redeemed for cash. In the event that a public shareholder tenders its shares and decides prior to the special meeting that it does not want to redeem its shares, the shareholder may withdraw the tender. If you delivered your shares for redemption to our transfer agent and decide prior to the special meeting not to redeem your shares, you may request that our transfer agent return the shares (physically or electronically). You may make such request by contacting our transfer agent at the address listed above. |

| Q. What should I do if I receive more than one set of voting materials | A. You may receive more than one set of voting materials, including multiple copies of this proxy statement and multiple proxy cards or voting instruction cards, if your shares are registered in more than one name or are registered in different accounts. For example, if you hold your shares in more than one brokerage account, you will receive a separate voting instruction card for each brokerage account in which you hold shares. Please complete, sign, date and return each proxy card and voting instruction card that you receive in order to cast a vote with respect to all of your Bull Horn shares. | |

| Q. Who can help answer my questions? | A. If you have questions about the proposals or if you need additional copies of the proxy statement or the enclosed proxy card you should contact: | |

| Bull Horn Holdings Corp. 801 S. Pointe Drive, Suite TH-1 Miami Beach, Florida 33139 Attn: Robert Striar Telephone: (305) 671-3341 | ||

| or: | ||

| Advantage Proxy, Inc. P.O. Box 13581 Des Moines, WA 98198 Attn: Karen Smith Toll Free: (877) 870-8565 Collect: (206) 870-8565 | ||

| You may also obtain additional information about the Company from documents filed with the SEC by following the instructions in the section entitled “Where You Can Find More Information.” |

We believe that some of the information in this proxy statement constitutes forward-looking statements. You can identify these statements by forward-looking words such as “may,” “expect,” “anticipate,” “contemplate,” “believe,” “estimate,” “intends,” and “continue” or similar words. You should read statements that contain these words carefully because they:

| ● | discuss future expectations; |

| ● | contain projections of future results of operations or financial condition; or |

| ● | state other “forward-looking” information. |

We believe it is important to communicate our expectations to our shareholders. However, there may be events in the future that we are not able to predict accurately or over which we have no control. The cautionary language discussed in this proxy statement provide examples of risks, uncertainties and events that may cause actual results to differ materially from the expectations described by us in such forward- looking statements, including, among other things, claims by third parties against the trust account, unanticipated delays in the distribution of the funds from the trust account and Bull Horn’s ability to finance and consummate any proposed business combination. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this proxy statement.

All forward-looking statements included herein attributable to Bull Horn or any person acting on Bull Horn’s behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Except to the extent required by applicable laws and regulations, Bull Horn undertakes no obligation to update these forward-looking statements to reflect events or circumstances after the date of this proxy statement or to reflect the occurrence of unanticipated events.

For a further discussion of these and other factors that could cause our future results, performance or transactions to differ significantly from those expressed in any forward-looking statement, please see the section entitled “Risk Factors” in our final prospectus dated October 29, 2020, as filed with the SEC on November 2, 2020, our Annual Meeting,Report on Form 10-K filed with the SEC on April 8, 2022, our Quarterly Reports on Form 10-Q filed with the SEC on May 10 and August 9, 2022, our proxy statement/prospectus included in the Form S-4 initially filed with the SEC on May 25, 2022, and in other reports we file with the SEC. You should not place undue reliance on any forward-looking statements, which are based only on information currently available to us (or to third parties making the forward-looking statements).